By JOHN HUGH DEMASTRI, CONTRIBUTOR | September 13, 2022

Read more at https://dailycaller.com/2022/09/13/inflation-drop-wont-stop-fed/

Inflation was at 8.3% in August, significantly exceeding economists’ predictions with core prices jumping even higher, according to data from the Bureau of Labor Statistics’ Consumer Price Index (CPI).

Core prices, which measures all prices less food and energy, remained elevated at 6.3%, slightly higher than July’s 5.9%, according to the BLS. With core prices remaining strongly elevated, it is unlikely that the Federal Reserve will slow its rate of interest increases designed to combat inflation, and will once again hike rates by 0.75% next week, according to The Wall Street Journal. (RELATED: Fed Unveils Bleak Forecast In Another Troubling Sign For The Economy)

Economists had predicted inflation to decrease from 8.5% to around 8.1%.

“The Federal Reserve will require at least three months of reassuring inflation data—along with evidence of a cooling labor market—before considering softening its tone,” said Mark Haefele, chief investment officer at UBS Global Wealth Management, according to the WSJ. This estimate is in line with the Federal Reserve’s estimate that the fight against inflation will likely take until the end of the year, according to a report.

The energy index continued to fall 5% from July, but energy costs have still increased 23.8% year-on-year, according to the BLS. Gasoline in particular remains high at 25.6%, down from 44.9% in July, with fuel oil remaining up 68.6% even after falling 5.9% in August.

Food prices posted the largest 12 month increase in 43 years, with a 11.4% year-on-year increase in national food prices, up from July’s 10.9%, according to the BLS. Prices for shelter also remain elevated, increasing 6.2% year-on-year, compared to 5.7% in July.

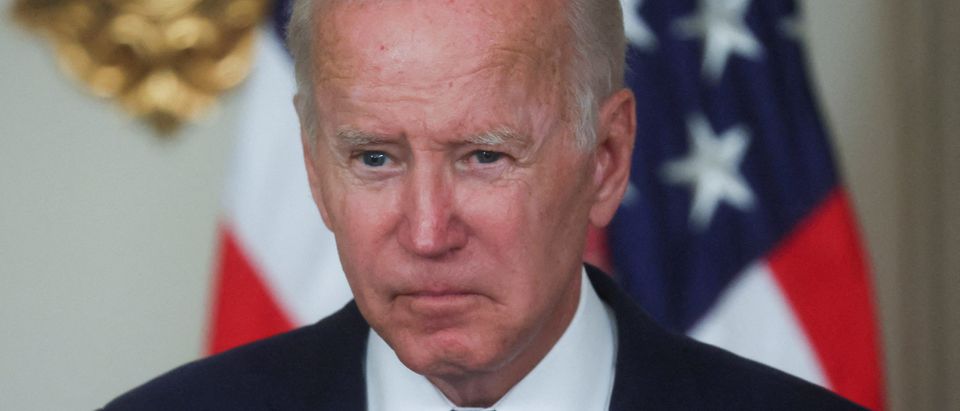

Under President Biden’s economic plan, we’re:

– Bringing home jobs that went overseas

– Making things here in America

– Making our supply chains more secure

– Winning the race for the future— The White House (@WhiteHouse) September 10, 2022

The Biden administration has been taking a victory lap on economic conditions, with Treasury Secretary Janet Yellen claiming that the U.S. had undergone an exceptionally rapid recovery “by any traditional metric,” in remarks at a Ford electric vehicle facility Sept. 8. She went on to say that “Household balance sheets are strong.”

The Federal Reserve, which operates independently of the Biden administration, has been less optimistic, and described the economy as “generally weak” in a report just one day prior to Yellen’s speech. Roughly half of the regional banks that comprise the Federal Reserve system reported that their regional economies were either stagnant or declining, with the remainder reporting either slight or modest growth.

“Last month President Biden made a huge production over a 0.0% month-to-month change in the CPI from June to July,” said Peter C. Earle, economist at the American Institute for Economic Research in a statement to the Daily Caller News Foundation. “There isn’t anything to celebrate in today’s July-to-August CPI numbers, so the likely spin will be to return to touting the so-called Inflation Reduction Act.”

"Thank You" for taking the time to comment. I appreciate your time and input.