REPORTED BY: JOY PULLMANN | APRIL 11, 2022

Read more at https://thefederalist.com/2022/04/11/the-government-could-stop-inflation-within-a-year-instead-expect-things-to-get-worse/

‘Moderate inflation results from short-term ‘stimulus;’ hyperinflation comes from regular money printing to pay the government’s bills.’

JOY PULLMANN

VISIT ON TWITTER@JOYPULLMANN

MORE ARTICLES

Know-nothing pundits and politicians have been communicating to Americans that inflation is, like the weather, a mystery they can’t control. That’s simply not true, write three economic commentators in a soon-published book, “Inflation: What It Is, Why It’s Bad, And How to Fix It.” On the contrary: inflation is a direct result of governments cheating their people, and solving it is pretty simple, if politically difficult.

In the book, businessman Steve Forbes, economist Nathan Lewis, and business journalist Elizabeth Ames give laypeople a concise, readable introduction to monetary policy. They also lay out easy-to-understand policy and personal prescriptions for responding to an inflationary economy such as today’s. The book is short and immensely useful for those of us who are not economic experts or finance minds and just want politicians to stop stealing our hard-earned money and endangering our nation’s security.

It would also be useful to members of Congress and other government officials with the authority to address what especially for the poorest Americans is a frightful economic situation. The authors lay out a one-year plan for stopping inflation in its tracks based on historical and international experience.

Inflation Is Not Just About Money

In the course of explaining what inflation is and how it works, the authors make the important point that it’s not just about money. Inflation is deeply connected to societal flourishing in general. Societies in which inflation is rampant are often unstable, chaotic, and violent.

“Markets are people,” the authors write. “When money is no longer a reliable unit of value, not only trade but social relationships ultimately unravel. Nations afflicted by extreme inflation end up experiencing higher levels of crime, corruption, and social unrest. As we have seen throughout history, the end result can be a tragic turn to strongmen and dictators.”

In an inflationary economy, the winners are the rich, the well-connected, and the corrupt. The losers are the poor, the middle-class, and those who work hard and play by the rules. Thus, an inflationary economy is inherently an unjust system. This is the top reason it should be combatted.

Not surprisingly, then, the rich and powerful often insist some inflation is a good thing. Maintaining a consistent level of inflation is in fact the Federal Reserve’s open policy goal. But even a “low” level of inflation such as The Fed’s (often wildly missed) target of 2 percent a year effectively steals significant income from especially the working and middle class. For someone earning $50,000 a year, 2 percent annual inflation is a $1,000 pay cut every year. That can be the difference between saving and not saving.

Making it harder to put money aside essentially forces middle and working-class people to depend on welfare rather than their own industry. Inflation thus erodes the middle class that is the bulwark of all free societies. So when it increases, societies tend to experience chaos. More people stop working and creating, and start trying to steal from others, either through government or through crime.

It should go without saying that an unstable society and economic chaos are threats to national security. These invite aggression from foreign enemies and hinders a nation’s ability to respond. This should make policymakers take inflation seriously, but like usual, so far politicians are mostly playing the blame game instead of solving the problem.

What Causes Inflation

Inflation is not merely rising prices, even sharply rising prices. That can occur for sensible reasons, such as sudden consumer demand for some fashionable item, or a crop failure leading to natural shortages. The authors define inflation instead as “the distortion of prices that occurs when money loses value.”

That can be seen, for example, in much of the current housing spike: “If you’ve made few, if any, home improvements and the local housing market isn’t on fire, you can be sure that the near-million-dollar sale price of your house doesn’t mean that it has magically become more valuable. Its worth has been distorted by a gradual, and totally artificial, decline in the value of the dollar,” explains “Inflation.”

When people stop trusting a currency as a stable measure of value, we get inflation. This is another way inflation is not solely about economics. It’s also about the people’s faith in their government and markets. That’s why lower-trust societies are more likely to experience inflation, and inflation is likely to worsen social trust. That’s also why inflation tends to spiral until somebody steps in to restore trust in the economy.

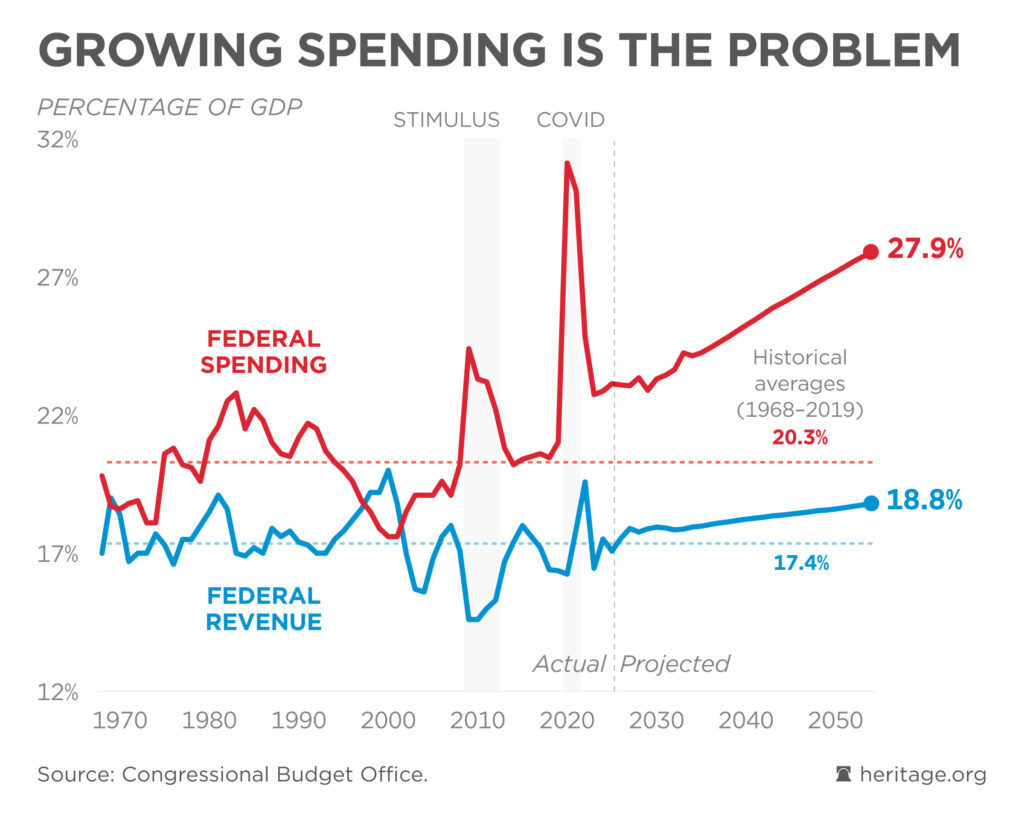

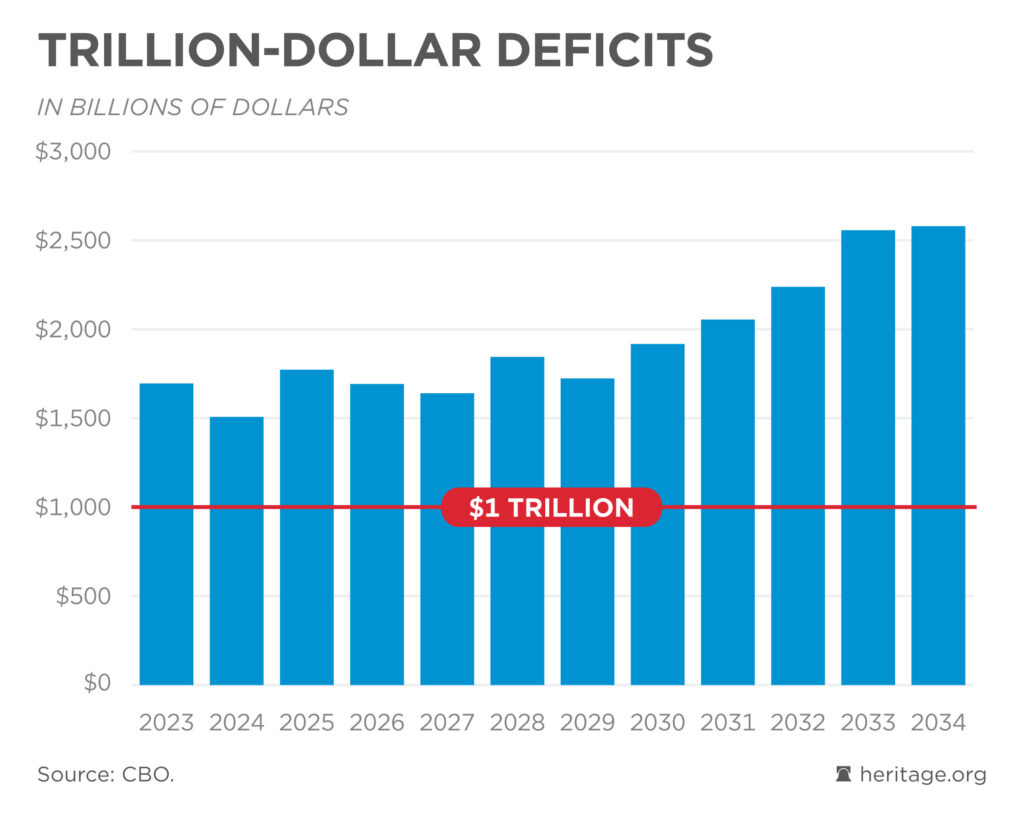

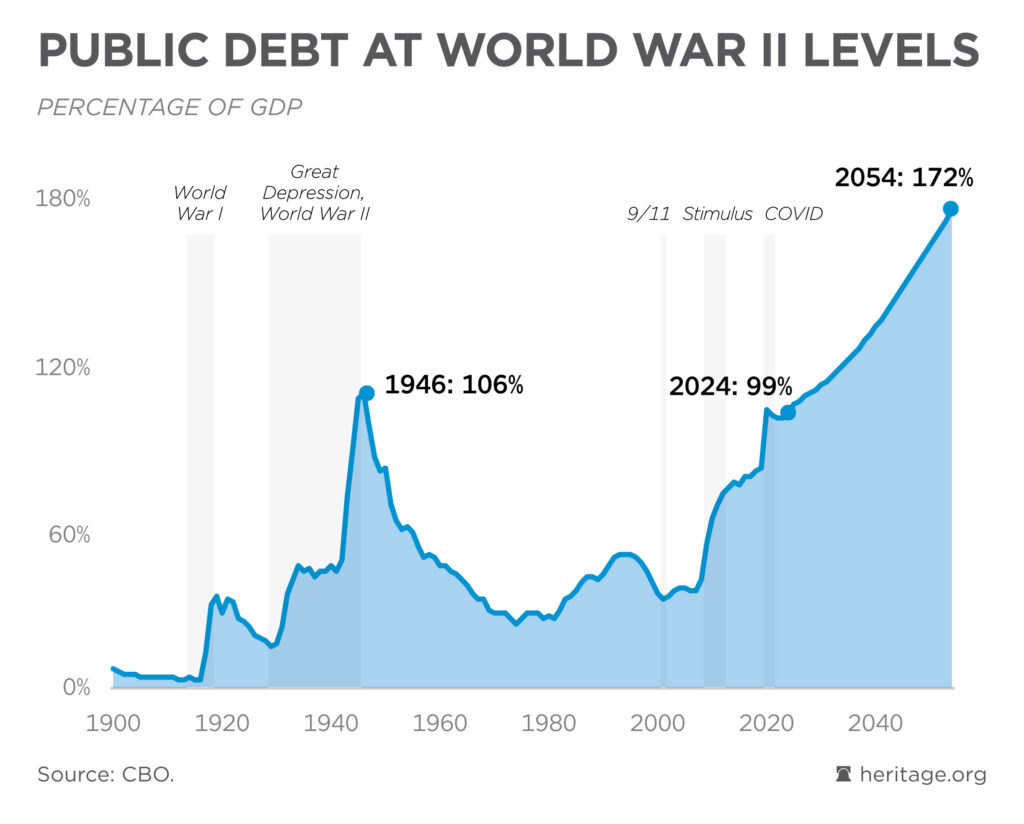

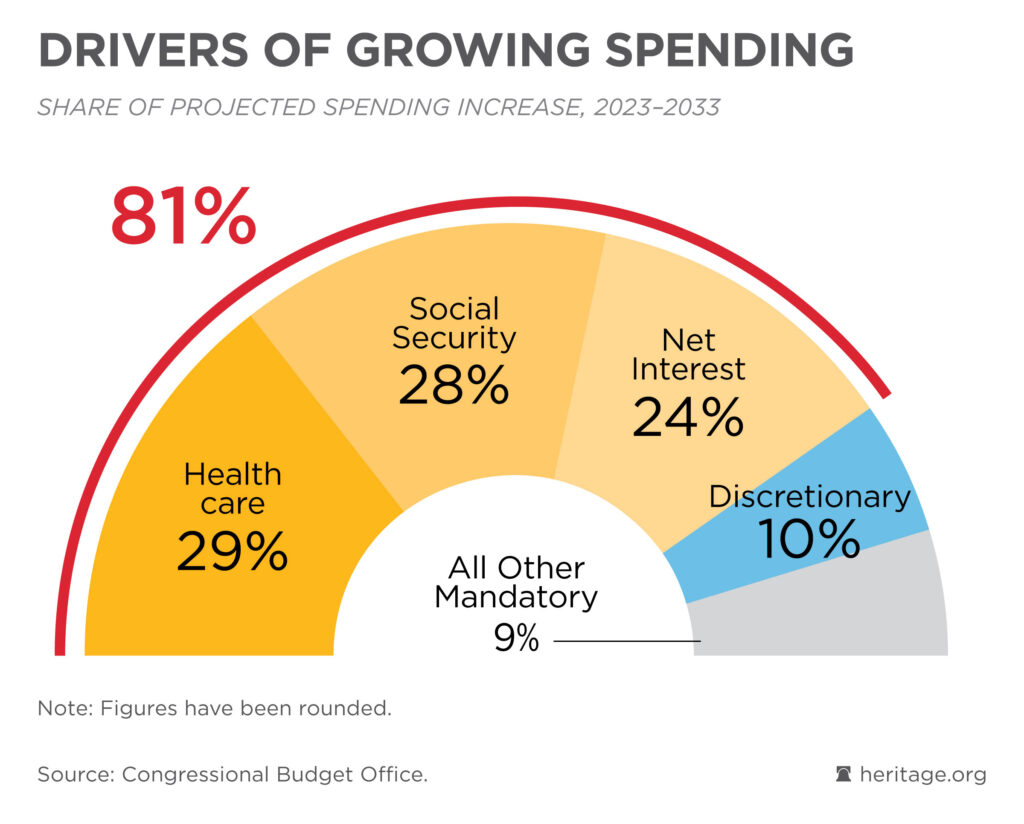

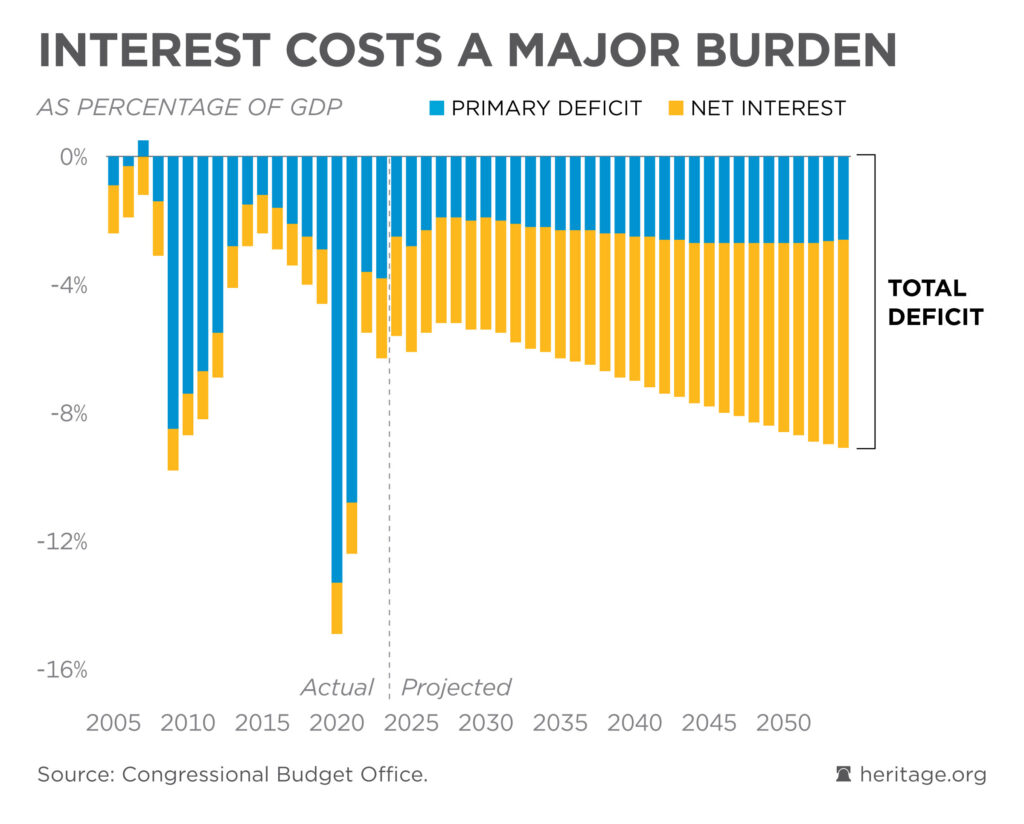

What causes inflation? If it’s true inflation, not price shifts caused by other market factors such as fads or innovation, it amounts to “a corruption of prices resulting from the debasement of currency by governments.” In other words, inflation happens when governments decide to circulate more money without a corresponding increase in economic value. This usually happens when governments want to spend more than they have, which is what the U.S. government has been doing for decades.

Today, the Federal Reserve essentially passes on federal debts and deficit spending to American consumers by creating more money without also creating new value. It is now one of many Western central banks that “effectively financ[es] their [government] deficits by buying their debt.”

In very simple terms, inflation is the result of governments spending far more than they can openly tax from citizens, then attempting to hide their shenanigans with financial gimmicks. So it is absolutely fair to think of inflation as a tax, and as the direct fault of shady government behavior: “Moderate inflation results from short-term ‘stimulus;’ hyperinflation comes from regular money printing to pay the government’s bills…The United States has not begun directly financing itself with large-scale money printing. Unfortunately, that may already be changing.”

Ending Inflation Is a Question of Political Will

The book helpfully explains in very clear and simple detail how the Federal Reserve enables Congress’s refusal to pay for its insane spending and how that all fuels inflation. It also discusses several intricate maneuvers by which this happens and why there isn’t a direct correlation in every case between money printing and inflationary effects. I won’t go into those here, but as a non-economist I did find them very helpful for understanding what’s going on.

I also found especially insightful the authors’ observation that federal overspending is not passed on to future generations, which is what I thought previously, but is inflated away from today’s workers and savers. Inflation is a tax on a nation that is unwilling to live within its means, and it occurs not in the future but in tandem with runaway government spending.

Ending inflation is quite simple, the authors say: “Stabilize the value of money.” Yet most “inflation remedies… more often than not end up making things worse.” That’s because government officials typically either misunderstand the root causes of inflation or are unwilling to take the steps necessary to address it. Thus, governments implement price controls or “austerity” measures, which usually further destroy their economies.

Instead, what’s needed is to tighten the money supply. The authors get into the details for doing this effectively, including their recommendation for the best way to ensure reliable money, a “new gold standard that would work in the twenty-first century.” They discuss this and respond to common arguments against it, still in highly readable prose.

Our Chief Obstacle to Fixing Inflation Is Ourselves

The key obstacle to implementing the authors’ one-year plan for restoring currency stability is widespread economic ignorance cultivated by leftist economists to preserve their control over policy. Yet given these economists have been wrong time and time again, it seems it’s high time to pay attention to experts whose recommendations have a reliable track record.

Unfortunately, since the majority of people working in Congress, the Federal Reserve, and similar commanding heights are the reason we’re in a dangerously inflationary economy in the first place, it’s probably too much to expect they will do anything other than make the situation worse in the near future. That’s why you’re hearing Joe Biden and other Democrats hint at making things worse with price controls or other punitive regulations by demonizing various industries for raising prices.

Not just because such people are at the helm, but also because they’ve already baked more money devaluation into the economic pie for the next several years, expect significant inflation to continue for quite some time. We can only hope and pray that the worst disasters of historic inflationary economies will be averted for us. And obtain some backyard chickens so we have something affordable to stick in the pot for dinner.

Joy Pullmann is executive editor of The Federalist, a happy wife, and the mother of six children. Sign up here to get early access to her next ebook, “101 Strategies For Living Well Amid Inflation.” Her bestselling ebook is “Classic Books for Young Children.” Mrs. Pullmann identifies as native American and gender natural. She is also the author of “The Education Invasion: How Common Core Fights Parents for Control of American Kids,” from Encounter Books. In 2013-14 she won a Robert Novak journalism fellowship for in-depth reporting on Common Core national education mandates. Joy is a grateful graduate of the Hillsdale College honors and journalism programs.

You must be logged in to post a comment.